Competitive Analysis for Startups

Startup founders often fall into two camps: those who obsess over competitors, and those who ignore them completely. The smartest approach lies in between: knowing your competitors inside and out is a crucial part of the job. A thorough competitive analysis is more than a one-time Google search; it’s an ongoing, systematic process of gathering intel and drawing insights. This guide will walk you through how to do a comprehensive competitive analysis for your startup, using a structured approach and real-world tips. We’ll cover how to identify your direct and indirect competitors, what key areas to research about each rival, where to find that information, how to organize and analyze your findings, and how to visualize the competitive landscape, including creating famous 2×2 competitor quadrants. Let’s go!

Identifying Direct & Indirect Competitors

The first step is identifying who your competitors really are. This sounds obvious, but many founders misidentify competitors – either assuming a giant industry player is a direct threat, when it’s not, or overlooking a scrappy newcomer that is. In competitive analysis, we talk about direct vs. indirect competitors:

Direct competitors: These offer very similar products or services to the same target audience. In other words, a customer might reasonably choose their offering instead of yours. If you run a food-delivery app, other food-delivery apps are direct competitors. If you make an AI-powered language learning tool, other AI language apps targeting the same learner segment are direct rivals. Direct competitors operate in your space, targeting the same needs with a comparable solution.

Indirect competitors: These serve the same customer need in a different way, or a different market with a similar solution. They aren’t offering an identical product, but they can still vie for your customers’ attention and dollars. For example, a local taxi company or public transit might be an indirect competitor to a rideshare app – they solve the “get from A to B” problem differently. Including indirect rivals in your analysis gives a more holistic view of what alternatives your customers have. Sometimes, an indirect competitor can even pivot or expand to become a direct competitor down the line.

How do you find these competitors? Start with your own industry knowledge and then broaden the search. Here are some tactics how to find competitors:

💭 Brainstorm and talk to customers: List the companies or solutions that come to mind when you think of the problem you solve. Ask potential customers what they currently use as a solution – “Which products or services would you consider as alternatives to ours?” Often, names that keep coming up in customer conversations merit a spot on your competitor list. This can reveal indirect competitors you hadn’t considered.

🏢 Leverage LinkedIn’s “Similar Pages”: On any company’s LinkedIn page (including your own), scroll to the “People Also Viewed” or “Similar Pages” section. This feature shows other companies that visitors tend to look at, which often include competitors or related businesses. It’s a quick way to surface players in the same space that may not be obvious from a basic web search.

🔍︎ Go beyond Page 1 of Google: A simple Google search for your product category is a start, but don’t assume the top three results are your only competition. Dig deeper, use different keyword combinations, and even try SEO tools. Smaller startups may not dominate search results or media headlines, so you need to search broadly to find them. Tools like SEMrush or Ahrefs can help identify sites competing for similar keywords, which might reveal “content competitors” – blogs or platforms addressing the same customer needs.

🤖 Use AI tools: LLM makes competitive research way easier. Instead of spending hours digging through competitor websites, pricing pages, and reviews, you can now use Deep Research to do the heavy lifting. LLMs can scan dozens of companies at once and show you how each one positions their product, what customers are saying, and where there might be gaps in the market. You can even spot trends, like if a competitor is quietly testing new features or changing their pricing. It’s like having a research assistant who never gets tired.

🔬 Keep an eye on adjacent markets: Sometimes your fiercest competition comes from another market or industry expanding into yours. For example, if you offer a niche software tool, a giant SaaS company with a broader suite might later add a feature that overlaps with your product. Stay alert to companies that could enter your space, even if they aren’t direct competitors today.

By the end of this exercise, aim for a “Top 5-10” list of competitors, a mix of direct and indirect, big and small. Be realistic – a massive tech giant can be indirect competition, but if your startup is early-stage, focus on peers in your weight class too. This list will be the foundation for all the research to come.

What to Learn About Your Competitors

Once you have your competitor shortlist, it’s time to dig in and gather intelligence. A thorough competitive analysis looks at a competitor from multiple angles. Here are the key research areas you should investigate for each rival:

Team & Leadership

Who’s behind the competitor? Understanding their team and leadership can give clues to their capabilities and priorities. Look up the founding team’s background – prior companies, domain expertise, and reputation. A competitor with seasoned founders or ex-FAANG engineers might execute faster or attract investors more easily. Also, check LinkedIn to see the company size and growth. How many employees do they have now, and is it growing? LinkedIn often shows an employee count range on the company page. If they list 50 employees now up from 30 last year, that signals momentum.

Employee review sites like Glassdoor are another goldmine. Glassdoor has anonymous reviews that can reveal internal strengths and weaknesses – e.g. complaints about poor management or praise of a strong engineering culture. This matters because a company struggling internally might falter externally. Glassdoor insights might even highlight which competitors have disgruntled talent you could potentially hire away.

Don’t forget to note any key hires or departures mentioned in press releases or on social media. If a rival just hired a CMO with 20 years in the industry, they likely plan an aggressive marketing push. If their CTO left, they may hit engineering roadblocks. Team insight helps you gauge how well the competitor can execute their strategy.

Strategy and Positioning

Examine how each competitor positions itself in the market. This is often gleaned from their mission statement, press interviews, and how they talk about their product. Are they targeting enterprise clients or consumers? Are they competing on price, quality, or a unique feature set? Understanding their strategy helps you see where they’re heading.

Start with a quick company overview: learn a bit about their history and mission. Many startups have an “About Us” page or a founding story on their blog. According to startup investors, a competitor’s overview should cover its history and mission, product focus, and unique value proposition. Ask: What core problem do they claim to solve, and for whom? For example, one project management tool might aim to be “the simplest task tracker for freelancers,” while another is “an enterprise workflow platform for large teams.” Those strategic choices (freelancers vs. enterprises, simplicity vs. all-in-one features) tell you how they differentiate.

Also analyze their business model and go-to-market strategy. Do they sell B2B with a sales force, or are they a self-serve SaaS? Are they focused on a particular geography or segment (e.g. targeting mid-sized businesses in healthcare)? Their pricing model is a big clue here – freemium and low-cost models often mean land-and-expand or volume plays, whereas high pricing might indicate an up-market enterprise focus. Reading interviews or founder quotes can be useful, too. Often, competitors will hint at their roadmap or strategic focus (“We believe the future of X is Y…”). If a competitor publicly emphasizes one aspect, you learn what they see as their edge.

In short, map out each rival’s strategy: who they target, how they win customers, and what their long-term vision is. This will later help you spot where your strategy can exploit gaps or counter their approach.

Product & Features

At the heart of any competitor analysis is the product. What exactly are they offering and how does it stack up against what you offer? Here’s how to break it down:

Core features and quality: Make a list of the key features of your competitor’s product or service. Most will be listed on their website or sales materials. What do they do better or worse than you? Perhaps their app has fewer integration capabilities, or their service covers two extra use-cases yours doesn’t. Try to experience their product, at the very least, sign up for a free trial. Note usability, design, and any standout pros/cons.

Product positioning: How do they brand and position their product? Are they portraying it as a premium solution or a budget alternative? Competitors often choose a niche or broad approach – do they focus on one key feature/niche (depth over breadth) or offer a wide range of features (breadth over depth)?

Pricing and monetization: Document their pricing model (one-time purchase, subscription, freemium, etc.) and price points. How do those compare to your pricing? Pricing reveals their target customer (e.g. an expensive enterprise software vs. a $9/mo small-business tool). Note if they offer free trials, discounts, or unique pricing strategies like pay-per-use. Pricing strategy is part of the product’s attractiveness and also part of their strategy (e.g., penetration pricing to gain market share).

Customer feedback on the product: Scour customer reviews and comments. Check sites like G2, Capterra, Trustpilot or App Store reviews for what users praise or complain about. If many reviews say, “Great features but uptime is unreliable,” that’s a weakness. If people gush about the user-friendly interface, that’s a strength. You can also search Reddit or Quora for your competitor’s name – you might find threads where users compare options and mention pros/cons. This real-world feedback highlights what the product’s real differentiators and pain points are.

The goal here is to understand the competitor’s product almost as well as your own. You want a clear picture of its feature set, quality, and where it shines or falters. This sets the stage for pinpointing how you can differentiate your product.

Marketing and Customer Engagement

Great products don’t win alone, you have to reach and win over customers. So, look at your competitors’ marketing:

Branding and messaging: Visit their website and social media profiles. What’s the tone of their messaging? Are they positioning as a friendly upstart, a trusted expert, an affordable alternative? The story they tell and the visuals they use (playful vs. corporate) give insight into how they connect with the target audience. Also note their key value propositions in marketing copy: are they highlighting price, innovation, customer service, etc.?

Channels and tactics: Identify where and how they market. Are they big on social media – posting daily on Twitter/X, LinkedIn, Instagram? Do they engage followers and respond to comments? Analyzing their social media can show their customer engagement strategy. If one competitor has a vibrant LinkedIn presence while another focuses on developer communities on Reddit, that tells you where each thinks their audience is. Also look for content marketing: do they maintain a blog, publish case studies, host webinars, or use SEO/keyword targeting (which you can spot via their blog topics or by using SEO tools).

Advertising and partnerships: Search for any paid ads or sponsorships. For example, do Google searches reveal your competitor’s Google Ads for certain keywords? Check if they appear at industry events or sponsor newsletters/podcasts. These tactics indicate how aggressive and well-funded their marketing is. Also note any partnerships or referral programs they tout.

Public relations and press: See if they have press releases or news articles. A Crunchbase or Google News search might show announcements about funding rounds, major customer wins, or product launches. Press strategy indicates how they gain credibility or attention. For instance, a competitor frequently in TechCrunch likely has a PR strategy to appear as a leader.

Community engagement: Some startups build community via forums, Slack groups, or by being active on Q&A sites. See if your competitors have a presence on Reddit, Quora, or community forums related to your industry. A strong community can be a moat, and if your competitor has passionate evangelists online, take note.

In analyzing marketing, ask yourself: What story are they trying to tell, and who are they trying to tell it to? Are they targeting tech-savvy early adopters via edgy tweets, or wooing corporate decision-makers with LinkedIn think-pieces? This will highlight how each competitor tries to acquire customers and build brand loyalty, and you might spot channels they aren’t utilizing –opportunities for you!

Traction and Metrics

Next, dig into any metrics or indicators of traction, essentially, how well are they actually doing? For private startups, exact figures can be hard to get, but you can gather clues:

User base or customers: Do they boast about number of users or clients? Phrases like “over 500 companies use X” or “1 million downloads” on their site or press releases give a sense of scale. If they publish case studies, note the types of customers featured (Fortune 500 companies? small businesses?).

Revenue: You likely won’t find revenue for private companies unless they voluntarily share it. However, you can estimate or infer. One rule of thumb from investors: estimate revenue by multiplying number of employees by an average revenue per employee. For a venture-funded tech startup, a common assumption is $150k–$200k revenue per employee as a ballpark. So if a competitor has ~50 employees (from LinkedIn) and is well-funded, they might be roughly in the ~$7–10 million revenue range. It’s a rough guess, so take it with a grain of salt. Also, check for any mentions of ARR (annual recurring revenue) in interviews or startup lists.

Growth rate: Look for signs of growth. Are they hiring aggressively (many new job postings on LinkedIn or Indeed)? Job postings can reveal expansion, e.g. opening new regional sales roles suggests geographic growth, lots of engineering roles suggests big product development plans. Also consider their social media follower growth or website traffic (SimilarWeb and Alexa can give rough web traffic estimates). A spike in activity or press over the last year could indicate they are gaining momentum.

Funding and financial runway: A major indicator of a startup’s power is how much funding they’ve raised. Use databases like Crunchbase to see their funding history and investors. Note the total capital raised and when. A competitor that just raised a $30M Series B last month is likely about to pour fuel on growth (and could be a threat), whereas a competitor that hasn’t raised in 5 years might be stagnant or running on revenue. Funding news also often comes with valuations or at least an implication of scale. Additionally, investor quality matters: top-tier VC backing can signal a well-resourced competitor, and also means that VC might not invest in you, since VCs avoid funding direct competitors.

KPI: Some companies share metrics like user retention, churn rate, or engagement if it’s a bragging point. Check if the competitor’s blog or pitch deck (if you can find one on SlideShare) has any metrics. For example, a fintech startup might tout “processed $1B in transactions” or a SaaS might say “20% month-over-month user growth.” Any such metric helps you quantify their traction.

In short, compile anything that indicates how well the competitor is performing in the market: user counts, growth signals, funding, press sentiment, etc. This will help later when you assess which competitors are truly threatening and which are lagging.

Investments & Financials

We touched on funding above, but let’s treat investment and financial status as its own research category because it’s so crucial for startups:

Funding rounds: Document each competitor’s funding rounds: how much, when, led by whom. Crunchbase is the go-to for this, as well as press releases. Pay attention to the dates: a competitor raising seed funding now might be on a similar timeline as you, whereas one that raised a Series C two years ago may be looking for exit or IPO soon. If a competitor is bootstrapped (no external funding), note that too – it can be a strength (independence) or a limitation (slower growth).

Investors and backing: Who has invested in them? Top-tier venture capital firms or strategic corporate investors can provide not just money but connections, credibility, and resources. If your competitor is backed by, say, Sequoia Capital, they have significant support. Also, as a strategy point, if you know certain investors are tied to your competitor, you might avoid approaching those same ones for your startup, since investors rarely invest in two direct competitors.

Use of funds and financial health: Sometimes you can infer what the money is fueling – e.g. if right after a funding round the competitor hires 20 people and launches an ad campaign, they’re spending on growth. On the flip side, if you see layoffs or slowed hiring, they might be conserving cash. Public data like business registrations or filings can show revenue or profit, but that’s rare for early-stage. However, government databases or regulatory filings might be available for larger or foreign competitors.

Monetization and runway: Are they actually generating revenue or still pre-revenue? A competitor who hasn’t figured out monetization (e.g. a free app with no ads or paid plan yet) could run out of steam unless new funding comes. Conversely, a competitor with strong revenue and moderate funding could sustain a price war or outspend you in marketing. Try to gauge how long their runway might be – $10M in funding with 50 employees might last roughly a year or two, depending on burn rate. Such insights are speculative but useful for understanding who might struggle or pull ahead in the long run.

By researching investments and financials, you’re essentially assessing each rival’s staying power and war chest. In the startup world, money translates to time and competitive advantage (hiring, marketing, product development). This context will inform how you position yourself, e.g., if you’re up against a heavily funded competitor, you might emphasize agility or niche focus instead of trying to out-spend them.

Data Sources for Competitive Research

How do you gather all this information? Fortunately, founders today have a wealth of data sources at their fingertips. Here are some of the most useful data sources and tools for competitive research:

Company Websites & Blogs: Start with the obvious. A competitor’s website is a brochure of their positioning, product, pricing, customer logos, and often a blog or news section. Read their homepage and product pages closely – this is what they want customers to know. Check for a “Press” or “News” page for any announcements. Their blog can reveal strategic focuses or new features being rolled out.

Crunchbase and Startup Databases: Crunchbase is a premier source for company “firmographics” – basic company info, funding history, key leadership, and sometimes revenue estimates. Look up each competitor on Crunchbase to get a snapshot of their location, founding date, employee count (often a range or an exact number if they claim it), and investors. Alternatives include CB Insights, PitchBook, or Dealroom for similar information (these may require subscriptions, but Crunchbase’s free tier is often enough). These databases help you quickly compare funding and size across competitors.

LinkedIn: Use LinkedIn for multiple angles. The company’s LinkedIn page shows employee count and recent hires or changes. You can often see people updates like new hires (“X joined as VP Engineering”) or departures if you dig a bit. LinkedIn is also useful to see the roles they are hiring: many companies post jobs on LinkedIn, which can show what teams are growing. Additionally, browsing employees of the competitor can reveal talent pedigree (if lots of ex-Google folks, etc.). As mentioned, LinkedIn’s “Similar Pages” feature can help identify competitors you missed.

Social Media: Follow your competitors on Twitter (X), Instagram, Facebook, and especially LinkedIn. Social media can give you real-time insight into their marketing campaigns, product updates, and how they interact with users. For example, you might notice they respond quickly to user questions on Twitter, or that their CEO is active on LinkedIn publishing articles. Social content and engagement levels can hint at their customer service ethos and popularity. Also, keep an eye on followers and engagement metrics, e.g. if a competitor has 50k followers with active engagement, they’ve built a community. Use social media not just to gather info but to gauge public sentiment (comments and replies often highlight what followers love or hate about the product).

Customer Review Sites: For product-focused insight, look at review platforms relevant to your industry. For B2B software, sites like G2 Crowd, Capterra, or TrustRadius compile user reviews and often allow side-by-side comparisons. You can literally compare your product’s rating vs. a competitor’s if you’re listed. Pay attention to the pros/cons in reviews – they will bluntly state where customers think each competitor shines or falls short. For consumer apps, check App Store and Google Play reviews. For physical products, Amazon or retailer sites. The qualitative feedback here is invaluable.

Online Communities (Reddit, Quora, Forums): Search Reddit for your competitor’s name or related subreddits (e.g. r/SaaS, r/smallbusiness, r/YourIndustry). Reddit often has candid discussions or even AMA threads by founders. Quora might have questions like “What is the best alternative to [competitor]?” or “Has anyone used [competitor]? How does it compare to X?” Those answers can surface lesser-known competitors and real user opinions. Niche forums or Slack communities (eg., a growth hackers forum or an industry-specific community) can also have chatter about products in your space.

Job Boards: As mentioned, job postings on sites like Indeed, Monster, Wellfound, etc., provide clues to a competitor’s growth and focus areas. If Company X is advertising 10 new roles for sales reps in various cities, they’re expanding sales aggressively. If Company Y is mostly hiring engineers, they might be in heavy product development mode. Job descriptions themselves sometimes reveal project details or new product lines. E.g. “seeking Android developer for our upcoming mobile launch” – oops, they just tipped you off that a mobile app is coming.

Press Releases and News Articles: Set up Google Alerts for your competitors’ names to catch any news. Press releases (often found on the company site or PR Newswire) announce partnerships, big customer wins, new feature launches, etc. Tech news sites (TechCrunch, VentureBeat, etc.) will cover funding announcements or major product launches. These articles can contain quotes from the CEO about strategy and often mention competitor context. E.g., “Startup X, competing with Y and Z, has raised funding to accelerate its AI platform...” which tells you who media sees as their competitors too.

Industry Reports and Rankings: If available, look at any industry analyst reports, Gartner Magic Quadrants, or buyer’s guides in your space. They might list the key players and compare them. This is more relevant in mature spaces, but even startup ecosystems sometimes have landscape infographics (e.g. Top 10 startups in [sector]). Such reports might mention market share or other macro data. Similarly, market research firms like Gartner, Forrester, or Nielsen sometimes provide market size and growth trends that can contextualize competitors (e.g. showing which segment is growing fastest).

Tools for Competitive Monitoring: There are also dedicated tools to track competitors. For example, Brandwatch or Mention can monitor social mentions of a company (so you see what’s being said about them). Tools like SimilarWeb and Alexa give web traffic comparisons. If you’re technical, setting up scrapers for competitor websites (to get product updates) or using APIs of App Stores for download counts can be useful. However, for a first-time founder, this might be overkill, start with the rich public data above.

Remember to organize as you gather. You’ll likely end up with a lot of snippets: a customer quote here, a funding figure there. In the next section, we’ll discuss how to compile this information logically.

Structuring Your Findings

With a pile of notes and data on each competitor, the next challenge is making sense of it all. This is where you need to structure your findings in a clear, comparable format. A popular approach is to create a competitor matrix, essentially a spreadsheet or table where you list competitors on one axis and key factors on the other. See the example below.

Competitor matrix example

For example, you might create a table with each competitor as a row, and columns for categories like Revenue, Number of users, Headcount, Product Features, Pricing, Target Market, Funding, Strengths, Weaknesses, etc. This way you can see side-by-side comparisons easily. List data points against each competitor in a grid. This becomes your one-stop reference document. What columns to include? Tailor it to your business, but common ones are:

Basic Info: Founding year, number of employees, headquarters location. This gives a sense of maturity and reach.

Product offering: Key features summary, product differentiators, any notable tech or IP.

Target market: Who they sell to, segment/geography, and use cases.

Pricing model: Price points, pricing strategy.

Marketing & sales: Main channels, brand positioning.

Traction/Size: Known metrics like customer count, revenue, funding raised.

Strengths: A bullet list of what they seem to do well. From product strengths, strong community, high growth, etc.

Weaknesses: A list of their apparent weak spots, eg., limited funding, narrow product scope.

It often helps to include your own startup in this matrix as well, so you can directly compare how you stack up on each factor. This matrix can feed directly into slides or docs for investors or internal strategy.

The key is to organize the data so that you can easily spot differences and similarities. When you line up competitors side by side, patterns emerge. You might notice, for instance, that three competitors target enterprise clients while two go after SMBs, or that one competitor is the only one using a freemium model. These insights might be missed if you look at each competitor in isolation.

Pro tip: Keep your competitor spreadsheet up-to-date. Think of it as a living document. Markets change and so do competitors: new funding, new products, new competitors emerging. Schedule a periodic review, say, once a quarter, to refresh the data. Update it as competitors scale, pivot or new ones enter, so you stay ahead of new developments.

Analyzing the Competition: From Data to Insights

Collecting data is half the battle – now you need to analyze and interpret what it means for your startup. This is where you turn facts and figures into strategic decisions. Here are some methods and frameworks to analyze competitors:

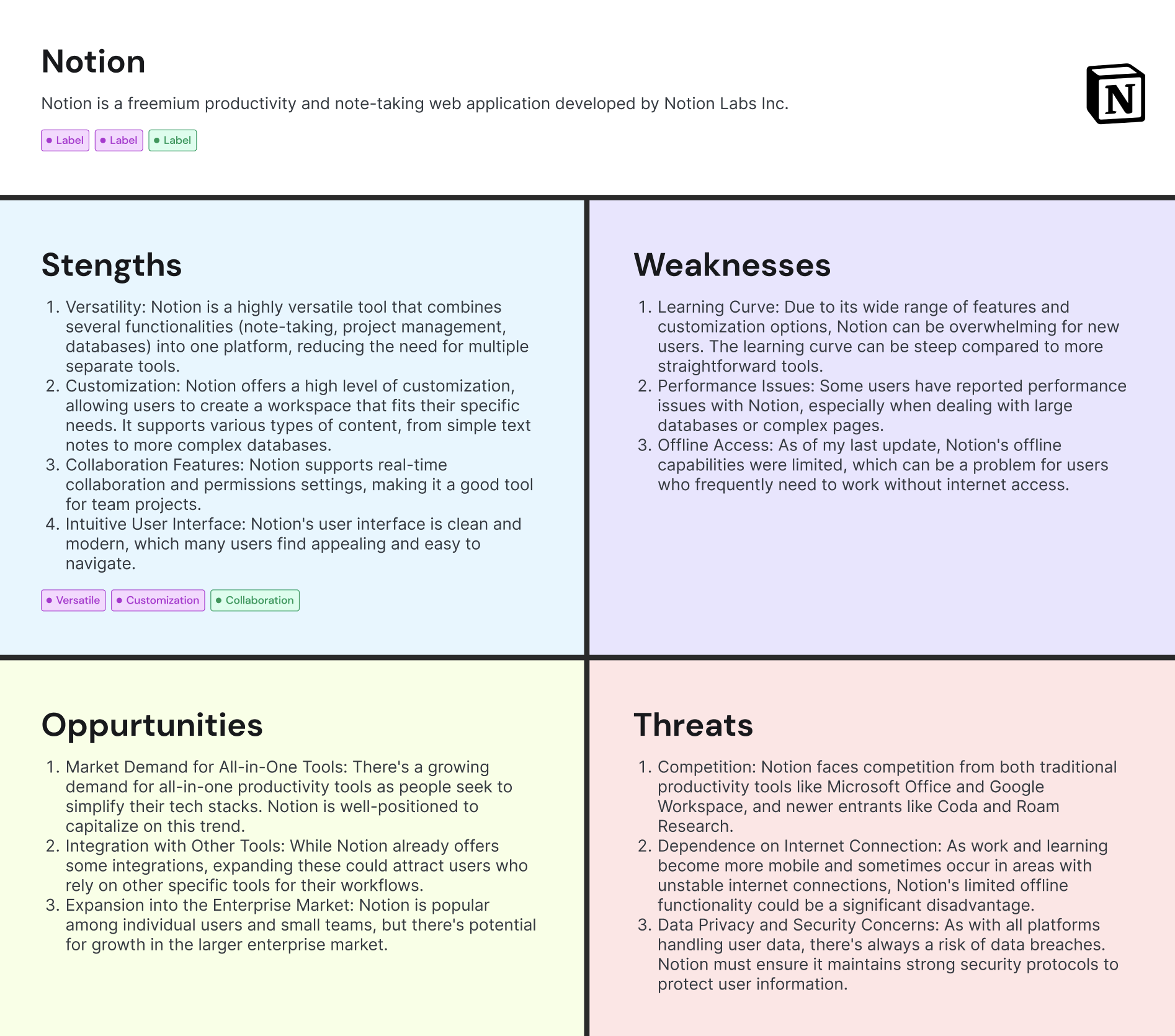

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats): A classic tool that can be applied to each competitor and yourself. For each competitor, summarize their internal Strengths and Weaknesses, and the external Opportunities and Threats they face. For example, a competitor’s strengths might be a strong brand and large user base, while weaknesses might be slow feature development. Opportunities could be a growing market or a new distribution channel, whereas threats might be new entrants or regulatory changes. Writing this out helps highlight where competitors are vulnerable and where they could expand. More importantly, it shows you where you have an opening. Perhaps a competitor’s weakness aligns with a strength of yours – that’s a point to exploit. Conversely, if a competitor has a big strength that you lack, you’ll need a plan to differentiate from it.

Benchmarking KPIs: If you have metrics for competitors (even estimates), benchmark yourself against them. How does your user growth or revenue compare to theirs at similar stages? If Competitor A has ~100k users and you have 1k, what are they doing in marketing or product that might explain it? Set up a simple table or chart of key metrics like users, revenue, engagement, growth rate. This can reveal who is leading and by how much. It can also provide realistic targets for your startup, e.g., knowing the market leader’s metrics gives you a north star for what’s achievable.

Feature Gap Analysis: If you listed features for each product, identify gaps – features you have that others don’t (your potential differentiators), and vice versa (areas you might be behind). E.g., if none of your competitors offer a certain integration or technology that you could build, that’s an opportunity to stand out. Or if all competitors have a mobile app and you don’t, that’s a glaring gap you need to fill. Consider making a simple features matrix (competitors vs. features with check marks) to visualize this. It’s essentially a mini “battlecard” to quickly see who offers what.

Market Positioning Matrix: Try to map out where each competitor sits in the market in terms of positioning. One way is to plot them on axes of two factors that matter in your industry (e.g. price vs. quality, or flexibility vs. ease-of-use). We’ll talk more about visualization next, but even before making a graphic, conceptually you can place competitors as “high-end vs low-end” or “broad vs niche” etc. This helps you identify white space. For example, you might realize all the existing players are targeting large enterprises, leaving a gap for a simple solution for small businesses (or vice versa).

Trend Analysis: Look at the trajectory of each competitor. Who is rising quickly and who’s plateauing? If Competitor B has doubled its customer base year over year and others are flat, B is a bigger threat long-term. Pay attention to momentum. Also, consider external trends: is the market big enough for multiple winners? Are customer preferences shifting toward one model? Align each competitor’s approach with macro trends to see who’s on the right side of history. For instance, if all competitors rely on human services and you’re using AI, and the trend is automation, that could be your strategic edge.

Investor/Market Sentiment: If you have access to commentary from investors or analysts (sometimes found in press articles about funding or on platforms like twitter or industry blogs), gauge the sentiment. Are people bullish on a certain competitor? Did a competitor fail or shut down recently (learn why, it can be instructive to avoid their mistakes). Sometimes how the market perceives a competitor (overhyped vs under-the-radar) can influence your approach, e.g. to either directly confront the big hype rival or quietly build in a niche they’re ignoring.

SWOT example for Notion

The end goal of analysis is to answer: “So what?” For each finding, ask how it impacts your startup’s decisions. If Competitor X has a huge social media following, so what – maybe you decide to double down on community-building or differentiate by focusing on another channel. If all competitors are expensive, so what – maybe you can win on affordability. If one competitor is faltering (bad reviews, layoffs), so what – perhaps an opportunity to capture their disillusioned customers.

Find your gap: Ultimately, you want to spot the gaps – those unmet needs or weaknesses in the market that your startup can exploit. It could be a customer segment underserved by others, a feature no one has, a superior customer experience where others are lacking, etc. Investors often say they want to know your competitive advantage. Your analysis should inform a crisp answer to that, e.g. “Unlike Competitor A and B who focus on enterprises, we target mid-sized companies who are currently overlooked and need a faster, self-serve solution, that’s our gap in the market.”

Finally, analysis should translate into actionable decisions. Maybe you alter your roadmap to build a feature sooner because every competitor has it. Or you adjust pricing because you found the market won’t support your original plan. Or you decide to emphasize a certain marketing message that contrasts competitors. The competitive analysis isn’t just a report to sit on a shelf – it’s meant to inform your strategy continuously. Use the intel to sharpen your value proposition and build a competitive moat around your business.

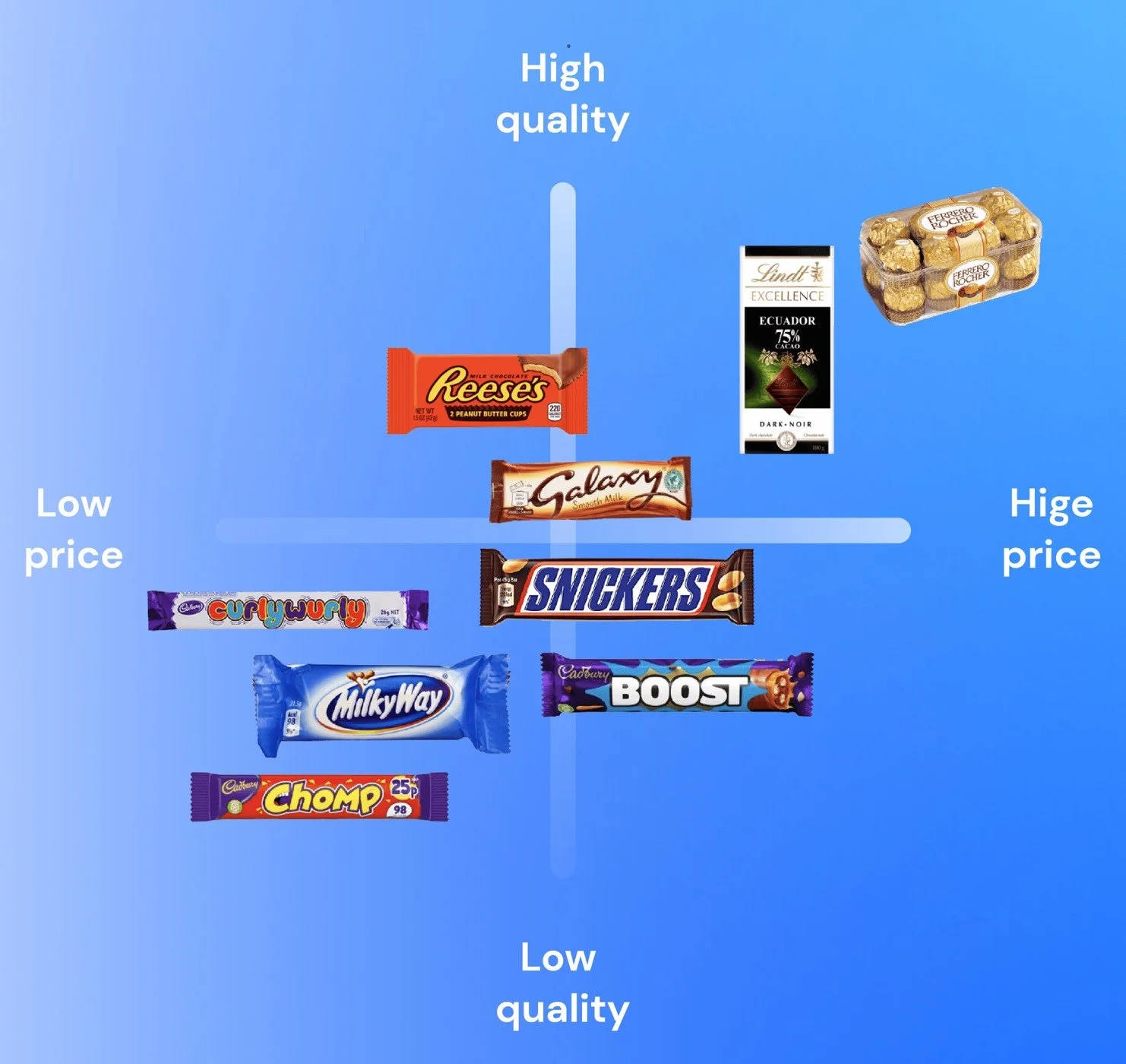

Competitor Quadrants

They say a picture is worth a thousand words, and this holds true in competitive analysis. Visualizing the competitive landscape can make it easier to grasp and communicate where everyone stands. One popular visual tool is the competitor quadrant (also known as a positioning map). This is essentially a graph with an X and Y axis, each representing a key factor, and each competitor plotted as a point on the graph. The axes should be the two most relevant dimensions that differentiate offerings in your market. Common examples of axes include “price (low to high)” vs. “quality (low to high)” or “simplicity vs. feature-richness,” or something like market presence vs. customer satisfaction. The idea is to see who’s in the coveted top-right, who’s bottom-left, and who is an outlier.

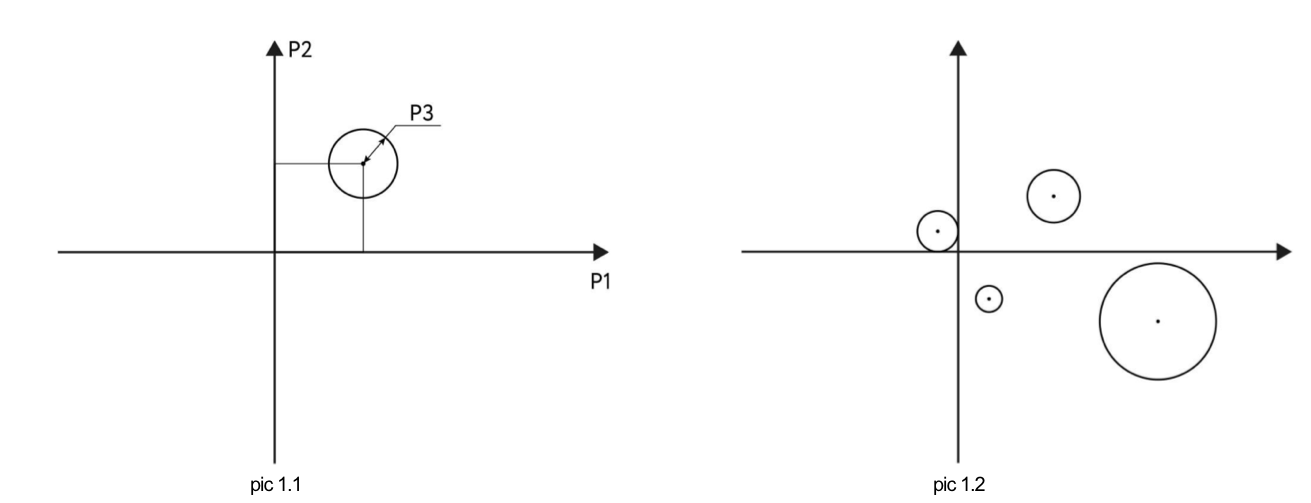

When you map your competitors visually, you start to see patterns that are impossible to spot in a spreadsheet. This is a competitive positioning map. In the picture 1.2, each company is placed on a simple two-axis chart based on the factors (P1, P2) that matter most in your market (eg., price, quality, speed, or whatever defines customer value). Each circle represents a competitor, its size (P3) reflects market strength (user base, revenue, or market share). This illustrates the competitive landscape as a whole. You can immediately see: who is closest to you, which segments are crowded, which competitor is strongest (biggest circle).

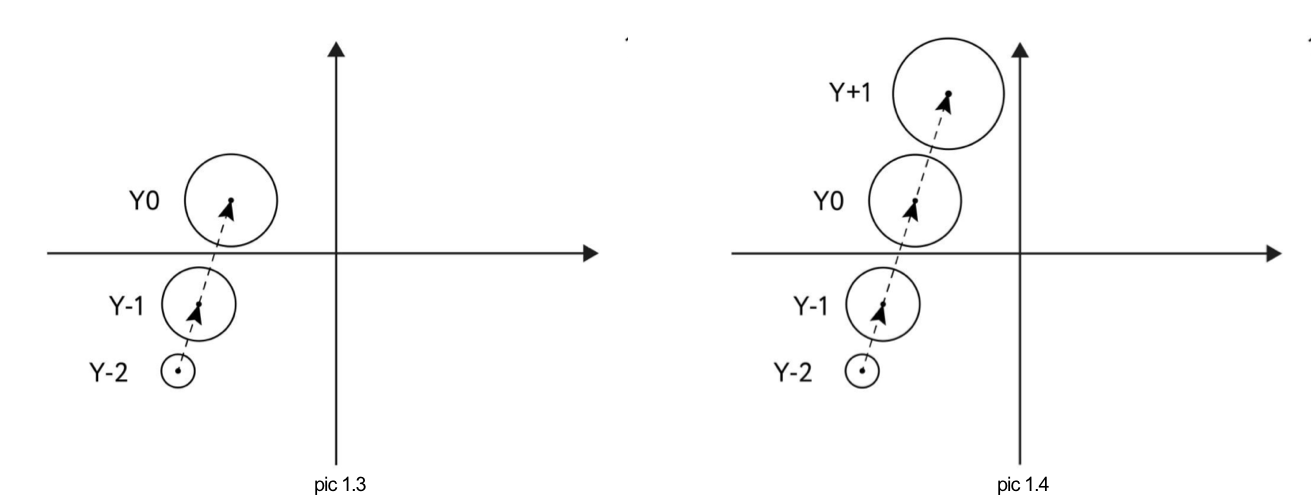

Let’s compare competitors on one dimension (pic. 1.3-1.4). Let’s say Y-axis = Quality of user experience. Then:

Y0 = typical competitor

Y+1 = premium competitor

Y-1 = low-quality competitor

Y-2 = bottom of the market

The dashed arrow is the direction of competitive improvement, showing how a competitor is moving upward.

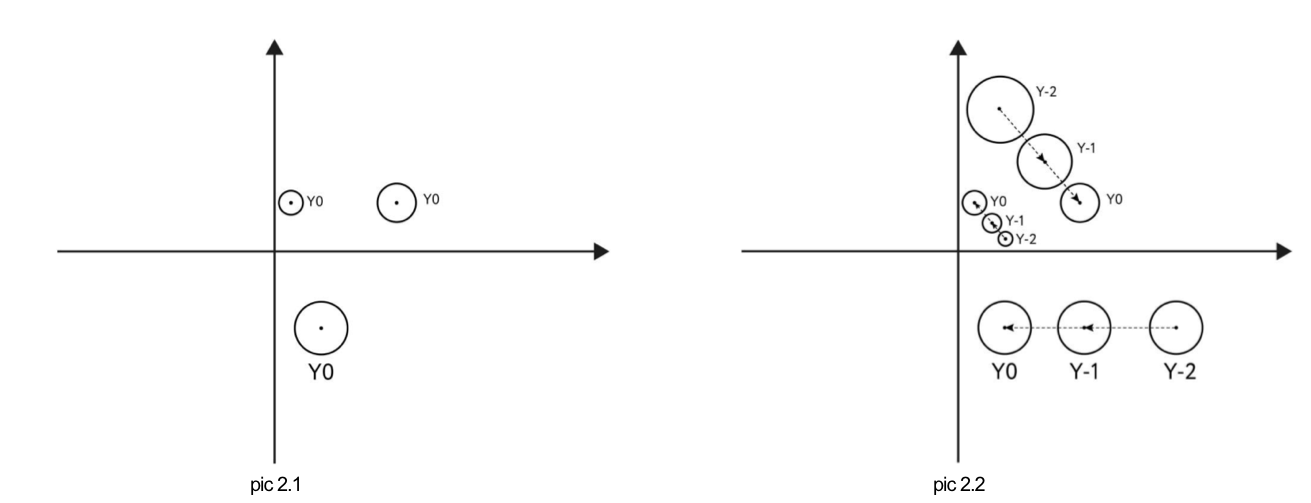

In this pic 2.1, all competitors are positioned around the same vertical level (Y0) but in different horizontal positions. This is a cluster of competitors who offer similar value, similar quality, or similar pricing, but differ slightly in how they approach the market. All products here deliver roughly the same customer value (Y0). But they differentiate sideways: feature set, niche audience, pricing model, etc. This shows that the market is crowded at this level, there is no clear winner, and it’s hard to differentiate without moving vertically.

Pic 2.2 shows multi-level competitor landscape. Now you see competitors distributed across multiple vertical tiers:

Y-2 (worst / cheapest / lowest quality)

Y-1

Y0

Y+1

Y+2 (best / premium / highest quality)

The dotted horizontal rows show the hierarchy of “levels” in the market. The arrows inside the bubbles show how each competitor is moving: some improving, some stagnating, some declining. Above the axis: higher tiers / Below the axis: lower tiers.

This is a tiered market. Some industries are structured exactly like this: Budget → mid-market → premium → luxury OR Starter tools → pro tools → enterprise tools.

This lets you see: where competitors are grouped, where movement is happening, which tier is shifting fastest, where your startup can enter the market, where the least competition exists.

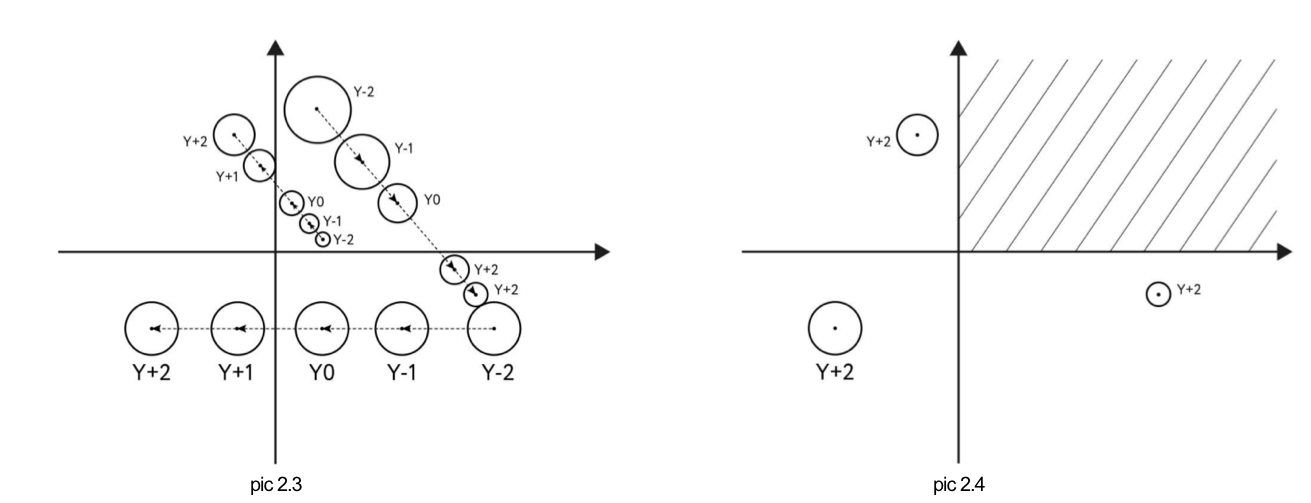

The pic 2.3 shows every horizontal level (Y-2 to Y+2) and every vertical band filled with competitors. It represents a totally saturated market: many competitors, multiple tiers, basic players and premium players, everyone doing similar things, small differences between players. Imagine CRM tools, fitness apps, travel booking apps — this is what reality often looks like. When all layers are full, competing head-to-head is a losing game. Your startup must change the axis: create a new dimension.

The pic 2.4 shows the goal for startups: a shaded “white space” where no competitor operates yet. This is the secret of competitive analysis: you’re not trying to beat rivals at their own game; you’re looking for the empty quadrant where your product can live without fighting anyone. That’s where category-defining startups are born. This is what strategy books call the Blue Ocean Strategy. Examples: Slack created a new category between chat apps and enterprise communication. Airbnb created a space between hotels and private apartments. Figma created a cloud design space where Adobe didn’t operate.

Visuals are especially handy when explaining the competitive landscape to others, be it potential investors, new team members, or even in pitch decks. Investors often expect to see a competitor slide, frequently in a quadrant format or similar, to prove you know your market.

When presenting these visuals, keep them simple and easy to read. Use clear labels (e.g. logos or names of companies on the quadrant points) and ensure the axes are self-explanatory. You’re telling a story: “Here’s where everyone stands, and here’s where we are.” If your visual shows you in a favorable position (like an untapped quadrant or a superior score on a key metric) – be sure your data backs it up if questioned.

Books We Recommend

Marketing Warfare by Al Ries

Vom Kriege by Carl von Clausewitz

The Art of War by Sun Tzu

Conclusion

A comprehensive competitive analysis arms you with knowledge, but its real power is in how you use it. By identifying direct and indirect competitors, researching their every move, and organizing those insights, you’ve essentially created a map of the battlefield. Now you can navigate with confidence and strategy.

Use your findings to sharpen your startup’s strategy. Double down on the areas where competitors are weak or the market is underserved. If your analysis uncovered an ignored customer segment or a feature gap, consider pivoting or emphasizing those in your roadmap. Conversely, address your own weaknesses that the analysis illuminated; if every competitor has feature X and you don’t, decide if you’ll build it or intentionally differentiate away from it.

Remember that competitive analysis is not a one-time task. Markets evolve, new competitors emerge, and old ones pivot. Make it a habit to keep an ear to the ground: set news alerts, periodically review competitor websites, update your competitor matrix, so you’re never caught off guard. Your understanding of the landscape should stay current.

Finally, balance focus on competitors with focus on customers. The goal isn’t to obsessively react to every move a rival makes, but to proactively find your own path to serving customers better. Competitive analysis is a tool to inform your decisions, not dictate them. As you iterate on your product and strategy, use the competition as a benchmark and inspiration, but stay true to your vision of solving customer problems in a unique way. Happy strategizing!

Competitive Analysis for Startups FAQ

What is competitive analysis in a startup?

Competitive analysis is the process of understanding who your competitors are, what they offer, how they price, how they attract users, and where they are vulnerable. For startups, it’s not about copying, it’s about finding where the market is weak and you can win.

Why is competitive analysis important for early-stage startups?

Because startups don’t die from bad ideas, they die from building the wrong thing. A good competitive analysis helps you avoid saturated markets, discover underserved users, pick smarter pricing, position your product clearly, save months of wasted development. It’s how you go from “another app” to “the obvious choice.”

How many competitors should I analyze?

Focus on: 3–5 direct competitors (same audience, same problem). And 3–5 indirect competitors (different solution, same pain). More than that becomes noise. You’re looking for patterns, not encyclopedias.

What should I compare when analyzing competitors?

At minimum: Target audience, Core features, Pricing & monetization, Onboarding flow, Positioning & messaging, Reviews & complaints, Distribution channels. The gold is always in what users complain about.

How do I find real competitors?

Don’t just Google. Use: App Store & Google Play search, Product Hunt, Reddit & Discord, YouTube reviews, Twitter conversations, G2, Capterra, Trustpilot. If people talk about it emotionally, it’s a real competitor.

What is the biggest mistake founders make in competitive analysis?

They focus on features instead of pain. Users don’t choose apps because of feature lists. They choose them because one product feels more right for their situation. Your job is to find: “Where are people frustrated, confused, or underserved?” That’s your opportunity.

Should I copy competitors?

You should steal patterns, not products. Copy what converts, what users love, what people complain about. Then build: faster, simpler, more focused. Winners don’t invent, they re-assemble smarter.

How often should I update my competitive analysis?

Every major product update, new pricing test, marketing pivot, fundraising round, new competitor launch. Markets move fast. Your competitive map should never be older than 3–6 months.

What tools are best for competitive analysis?

Popular options: SimilarWeb, App Annie, Sensor Tower, Ahrefs / Semrush, App Store reviews. But honestly, customer reviews + common sense beat expensive tools.

Can I win if big competitors already exist?

Yes. In fact, that’s usually a good sign. Big players mean: Proven demand, Educated customers, Money in the market. Your advantage is speed, focus, and niche obsession. Giants serve everyone. Startups serve someone perfectly.

What is competitive positioning?

It’s how your product lives in the user’s head. Not: “We have better features”. But: “We are the easiest way for X to solve Y.” If users can’t explain your product in one sentence, you don’t have positioning, you have confusion.

How do I know if my idea is too crowded?

If competitors all have the same messaging/All target the same users/All use the same pricing/All look the same. Then the market is begging for a fresh angle. Crowded markets don’t mean “don’t enter.” They mean “differentiate or die.”