KPI for a startup. How to define KPIs for startups

KPI means Key Performance Indicator. KPI should show how well your startup is performing in the most important aspects. For many startup founders, the question about KPIs is always challenging. So, we will cover this topic in simple words.

On a pro level, you can measure every aspect of your business, from Customer Acquisition Cost to a Net Promoter Score. But in the early stage, you don't need to have a lot of KPIs. Two-three will be enough. The main idea is to have them as indicators of the health of your business.

For example, in the case of Airbnb – the number of booked nights is a great KPI. Per day, month, year. Does it grow every week? How does this compare to the hotel business?

For example, in the case of Uber, it can be the number of daily rides. What is the month-to-month growth? What is the number compared to the classic taxi business?

For example, for eBay, it can be the number of deals. Again, per day, month, or year. It's easy to measure and valuable to know.

KPI should show the state of your business. Only by checking this one indicator, you should understand if your business is growing or not.

But please don't fall into the trap of vanity metrics. Likes, followers, views, and reposts in your socials bring zero value to your business model. Stay focused.

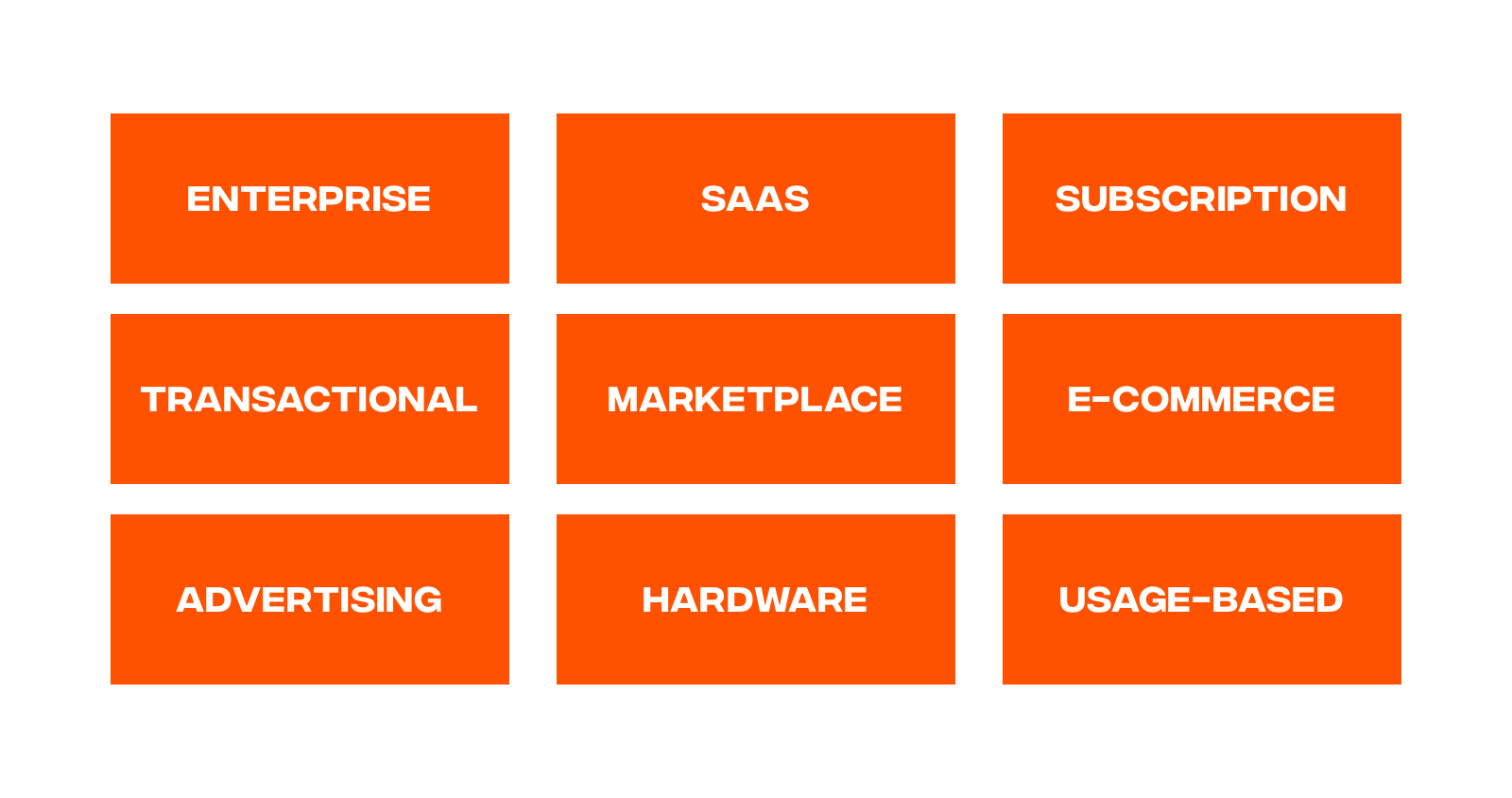

Startup Business Models & Metrics Examples

1. Enterprise

This is a company that sells software or services to a large enterprise.

Examples: Freshworks, Druva.

Large enterprises tend to work in contracts. Within these contracts, three components comprise the metrics you want to track.

Key Metrics to track:

Bookings - Total number of commitments you have from companies that will pay you for your service.

Total Customers - Total number of companies that you have received a booking from.

Revenue - When your company has fulfilled the commitment outlined in the contract to the company, and the money is in your company's bank account.

Common Mistakes for Enterprise:

Confusing "Bookings" and "Revenue".

Counting Letters of Intent or Verbal Agreements towards your "Bookings" metric.

2. SaaS

This is a company that sells subscription-based licenses for a cloud-hosted software solution.

Examples: Zoho, Postman.

SaaS is really a subscription business. You charge monthly for the software that you provide.

Key Metrics to track:

Monthly Recurring Revenue (MRR) - Hopefully, you have built something that people really like, and they'll continue to use it and pay you every month.

Annual Recurring Revenue (ARR) - This is good to track compared with MRR, as it shows the pace of revenue compared to just the absolute revenue number.

Gross Monthly Recurring Revenue Churn (Gross MRR Churn) - When you're in the early stage and have only a few customers, losing even one or two has a real impact on your revenues.

Paid Cost to Acquire Customers (Paid CAC) - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

Common Mistakes for SaaS:

Don't use Annual Recurring Revenue (ARR) and Annual Revenue Run Rate interchangeably.

Don't include one-time payments in Recurring Revenue calculations.

3. Subscription

This is a company that sells a product or service — usually to a consumer — on a recurring basis.

Examples: Cult.fit, Byju's.

The main difference between SaaS and subscription is the cost per sale. In subscription-based models, the cost is usually much lower on a per-customer basis. Because of this, track monthly growth churn and unit churn, not dollar churn. Revenue is distributed more evenly across customers, so you get a better representation of the company by measuring users and not dollars.

Key Metrics to track:

Monthly Recurring Revenue (MRR) - Revenue for recurring services per month. This does not include one-time or non-recurring revenue, such as fees and professional services.

Monthly Recurring Revenue Compound Monthly Growth Rate (MRR CMGR) - When you're still small because of the small sample size, your MRR will be spiky. This smoothes out those spikes (in a way that doesn't hide downturns like simple averages.)

Gross User Churn - In comparison with SaaS, you want to track user churn instead of revenue churn.

Paid CAC - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

Common Mistakes for Subscription:

Don't measure CMGR as a simple average — use discrete monthly growth rates.

4. Transactional

This is a company that enables a financial transaction on behalf of a customer and collects a fee (usually a percentage of the underlying transaction).

Examples: Paytm, PhonePe.

If you're a business that processes someone else's payment volume, then you should put yourself in the transactional bucket.

Key Metrics to track:

Gross Transaction Volume - If you have 30 customers going through your company processing $100 million in total transactions, that's GTV. But the volume of payments that goes through your platform isn't revenue, which leads us to Net Revenue.

Net Revenue - This is the money that you take out of the transactions flowing through your platform — that goes into your bank account.

User Retention on a Monthly Basis - Because of the nature of transactional businesses, you will likely have a large volume of customers. Because you're powering your customer's ability to make money, there should be no reason for them to stop using your platform.

Paid CAC - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

Common Mistakes for Transactional:

Confusing Gross Transaction Volume with Net Revenue.

User retention is a COHORT metric. A cohort is a set of users acquired within a specific time frame.

5. Marketplace

This is a company that acts as an intermediary between two consumers, connecting them to buy or sell a good or service.

Examples: eBay, Airbnb.

Marketplaces connect sellers and buyers to exchange goods or services. This differs from Transactional companies in that Transactional companies help people process the financial transactions themselves.

Key Metrics to track:

Gross Merchandise Value (GMV) - If a host on Airbnb lists a $100/night room for two nights, that's $200 Airbnb can count towards their GMV.

Net Revenue - The percentage of the GMV that Airbnb gets in their bank account.

Net Revenue Compound Monthly Growth Rate (Net Revenue CMGR) - Since Marketplaces are typically consumer-based, the volume of users matters. Again, as opposed to averages, this is a more honest way of understanding how much you are growing.

User Retention - As mentioned above, you pay attention to the volume of users as opposed to revenue retention.

Paid CAC - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

Common Mistakes for Marketplace:

Blending paid user acquisition with organic user acquisition.

6. E-commerce

This is a company that sells goods online. Generally, they manufacture and inventory those goods.

Examples: Snapdeal, BigBasket.

In E-commerce, you may make the products OR source the products, but ultimately, it's your brand — and people are coming to the brand to purchase it.

Key Metrics to track:

Monthly Revenue - There are no recurring purchases, so simply track revenue per month.

Revenue Compounded Monthly Growth Rate (Revenue CMGR) - Again, because it's consumer, track volume, and because averages aren't the whole picture, track compounded.

Gross Margin - (Calculated by gross profit in a given month / total revenue in the same month) How much money are you making for each thing you sell? And it's even more important because it's not recurring — you need to ensure you're making money on each transaction.

Paid CAC - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

Common Mistakes for Marketplace:

Not accounting for ALL costs that factor into Gross Profit.

7. Advertising

This is a company that offers a free service and derives revenue from selling advertisements placed inside the free service.

Examples: Inmobi, Zomato.

At such an early stage, you’re not anywhere close to monetizing if you are in the Advertising business. Because of this, it’s ALL ABOUT THE USERS. Because of this, there are only 3 metrics that matter.

Key Metrics to track:

Daily Active Users (DAU) - Number of unique active users in a 24-hour day, averaged over a period of time.

Monthly Active Users (MAU) - Number of unique active users in one-month period.

% Logged In - MAU with a registered account/total unique visitors over the same 28-day period.

Common Mistakes for Advertising:

Not reasonably defining what “Active” means.

8. Hardware

This is a company that sells physical devices to consumers.

Examples: Rivigo, Lenskart.

Very similar to E-Commerce. All the metrics are the same.

Key Metrics to track:

Monthly Revenue - There are no recurring purchases, so simply track revenue per month.

Revenue Compound Monthly Growth Rate (Revenue CMGR) - Again, because it’s consumer, track volume, and because averages aren’t the whole picture, track compounded.

Gross Margin - How much money are you making for each thing you sell? And it’s even more important because it’s not recurring — you need to ensure you’re making money on each transaction.

Paid CAC - Hopefully, you're acquiring users organically, but eventually, you will experiment with paying to acquire users once you reach a particular stage.

9. Usage Based

Pay-as-you-go based on consumption in a given period.

Examples: Ola, Swiggy.

Key Metrics to track:

Monthly Revenue - There are no recurring purchases, so simply track revenue per month.

Revenue Compound Monthly Growth Rate (Revenue CMGR) - Again, because it’s consumer, track volume, and because averages aren’t the whole picture, track compounded.

Revenue Retention - % of revenue from last month’s customers in this month.

Gross Margin - How much money are you making for each thing you sell? And it’s even more important because it’s not recurring — you need to ensure you’re making money on each transaction.

Common Mistakes for Usage Based:

Don’t confuse usage-based revenue with recurring revenue.

Tracking Key Performance Indicators (KPIs) is crucial for startups as it provides a precise performance measure, aiding in informed decision-making. KPIs align individual efforts with overall goals, optimize resource allocation, and detect potential issues early. Positive KPIs enhance investor and stakeholder confidence, while customer-related metrics help improve products and services. Monitoring KPIs enables startups to adapt to market changes and ensures a systematic approach to business management for long-term success.

If you need any help with your startup idea – feel free to contact us. We provide the first 30-minute consultation free of charge!